by Don Vialoux, Timingthemarket.ca

Observations

Frontier iShares (FM $26.26), based on a list of 100 liquid equities listed outside of developed nations, completed a Reverse Head & Shoulders pattern on a move above $25.57.

Interesting “bump” in base metal and base metal equity prices at a time when their period of seasonal strength turns positive.

Nice pop in Base Metal ETN based on copper, zinc and aluminum futures

Nice pop in Copper Miners ETF

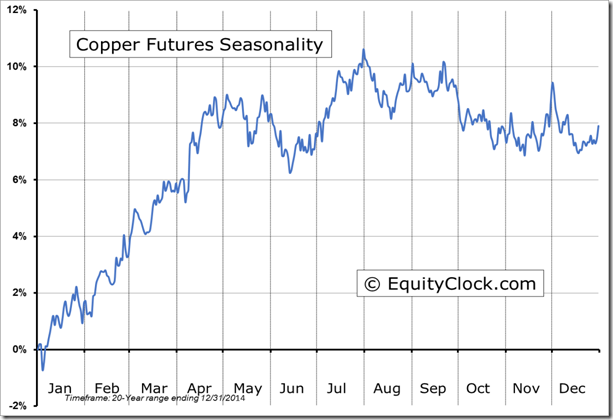

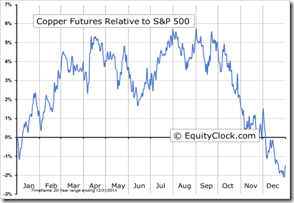

Seasonal influences for copper are turning positive on a real and relative basis.

FUTURE_HG1 Relative to the S&P 500 |

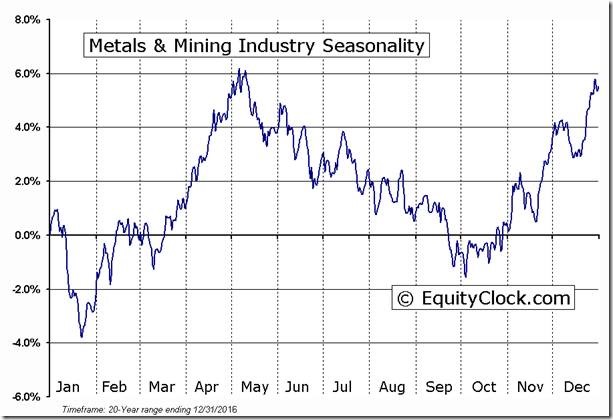

Seasonal influence for Metals and Mining stocks turns positive this week.

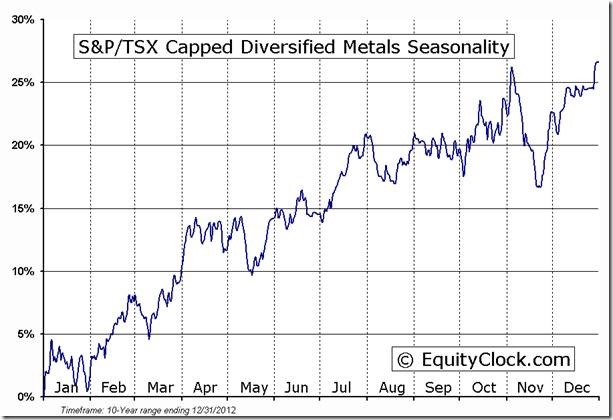

Ditto for Canadian base metal stocks (starting later this month)!

StockTwits Released Yesterday @EquityClock

Energy and Utilities lead market lower on Monday.

Technical action by S&P 500 stocks to 10:00: Quietly bearish. No breakouts. Breakdowns: $DISCA $DISCK $HPQ $AWK

Editor’s Note: After 10:00 AM EST, eight stocks moved above intermediate resistance: RCL, ALK, BDX, ISRG, SYK, DHR, GM and CMG. None broke intermediate support.

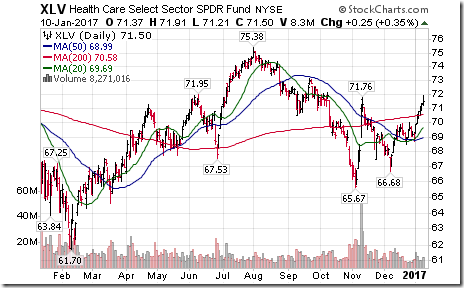

Health Care SPDRs $XLV moved above $71.76 extending intermediate uptrend.

General Motors $GM moved above $37.74 extending intermediate uptrend.

Trader’s Corner

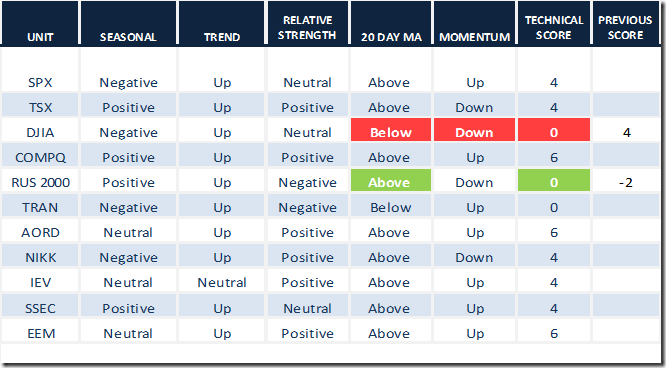

Daily Seasonal/Technical Equity Trends for January 10th 2017

Green: Increase from previous day

Red: Decrease from previous day

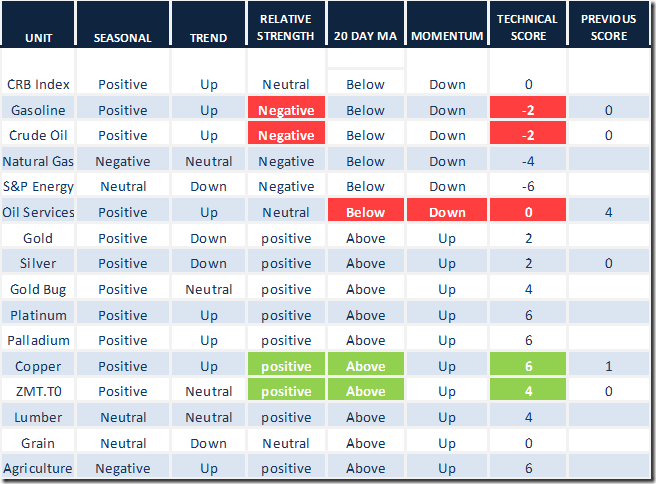

Daily Seasonal/Technical Commodities Trends for January 10th 2017

Green: Increase from previous day

Red: Decrease from previous day

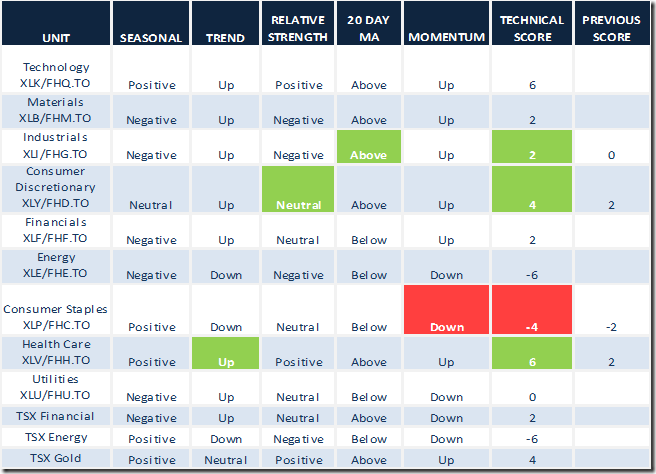

Daily Seasonal/Technical Sector Trends for January 10th 2017

Green: Increase from previous day

Red: Decrease from previous day

John Johnston’s interview on Michael Campbell’s Money Talks

John Johnston joined Mike on the weekend to help put us on the right track for 2017. John talks about the competitiveness pressures looming for Canada, trade and tariffs risks, and the implications for the Canadian dollar…. CLICK HERE for the full interview

S&P 500 Momentum Barometer

The Barometer dropped another 3.00 to 74.20 yesterday. It remains intermediate overbought and continues to show early signs of rolling over.

TSX Momentum Barometer

The Barometer added 1.27 to 73.84 yesterday. It remains intermediate overbought and shows early signs of peaking.

Disclaimer: Seasonality and technical ratings offered in this report and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca