by Blaine Rollins, CFA, 361 Capital

While politics and the new government’s agenda is still very much in the news, investor interest last week shifted to the bigger picture. Good economic data continues to hit the tape along with better-than-expected corporate earnings growth and outlooks. Rising inflation and interest rate expectations are pulling the Fed’s hand closer to the red button (which they still plan on punching three times this year). Credit spreads continue to tighten as corporate and consumer credit losses seem miles away from investors. A Border Tax seems less likely by the day as opposition, complexity and the molasses hallways of government slow its momentum. The upward sprint of the markets last week was clearly focused on the positives. Let’s see if that continues this week.

Ed Yardeni had a good quote…

“The reality is that the real G.D.P. of the economy has never been higher and that consumer spending per household is at an all-time high,” said Mr. Yardeni, who has been arguing for some time that markets have been obsessing needlessly over worrying headlines.

“Throughout all these corrections, people have been talking about an endgame,” he said. “Maybe people have figured out that you can watch the news all you want and get upset, but that has nothing to do with earnings and the valuation of earnings in the stock market.”

(NY Times)

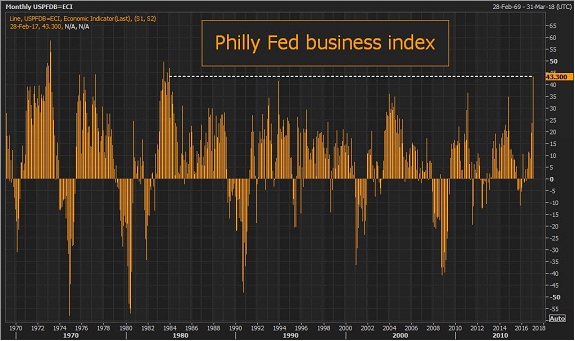

Now for the data, one of Janet Yellen’s favorite economic indicators blasted off last week…

@ReutersJamie: Philly Fed index jumps to 43.3 from 23.3, highest since Jan 1984. Was expected to fall to 18.0.

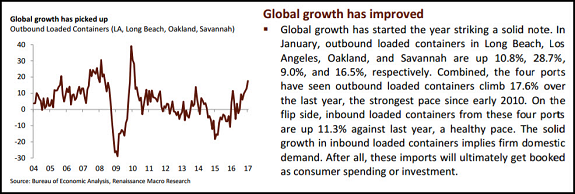

A good RenMac chart of outbound containers confirms the global growth story…

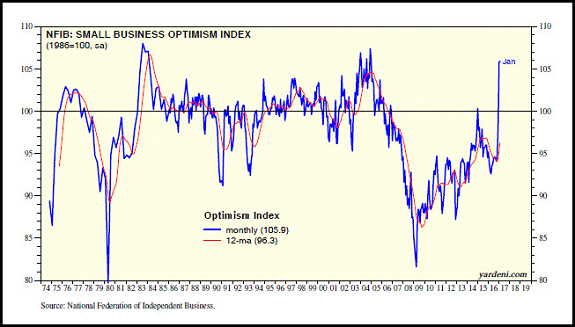

Meanwhile, the Small Business Optimism Index is surging…

Small businesses add up to a big portion of our economy. They currently employ 49.9 million workers, accounting for 40.5% of private-sector payrolls, according to data compiled by ADP. Since the start of the data during January 2005, small business payrolls have increased by 5.9 million, surpassing the gains by medium-sized (5.0 million) and large (1.2 million) companies over the same period.

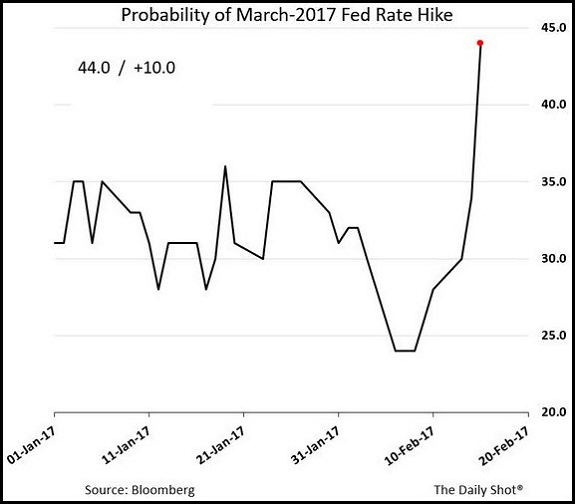

Janet Yellen visited Congress last week and she told us how she is positioning…

“As I noted on previous occasions, waiting too long to remove accommodation would be unwise, potentially requiring the FOMC to eventually raise rates rapidly, which could risk disrupting financial markets and pushing the economy into recession.”

(Janet Yellen, Federal Reserve Chair)

After the Philly Fed data release and the Fed Chair’s testimony to the Senate, the market moved quickly to up the odds of a March Fed rate hike…

(@soberlook)

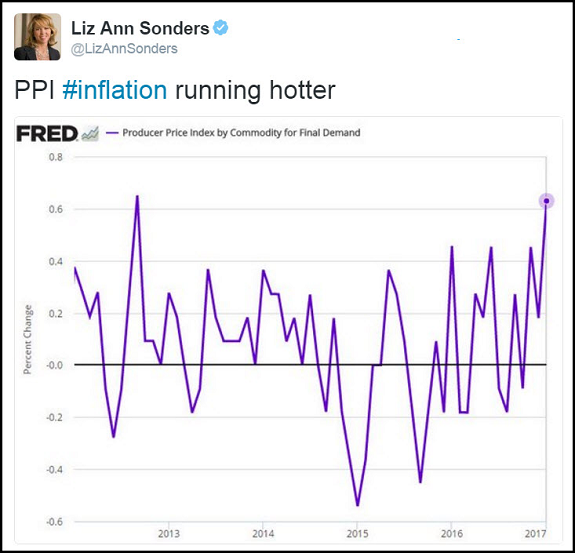

Big consumer product companies had further mentions of inflation…

”It appears, we’ve now reached the bottom on commodities and are likely to have to contend with commodity inflation beginning in Q1 of this year…in 2017, when we take a look at the spot and forward rates, we’re likely to see year-over-year inflation. And we’re already seeing that in cheese, coffee, bacon” (Kraft Heinz CFO, Paulo Basilio)

“As we look forward into 2017, in the first half in particular, before we lap the inflation that we saw in 2016, we do expect to see a higher level of low single-digit inflation in commodities. And that combined with our annual pricing outlook will probably result in a bit of pressure on gross margins.” (Pepsi CFO, Hugh Johnston)

And we are seeing inflation in the broader measures…

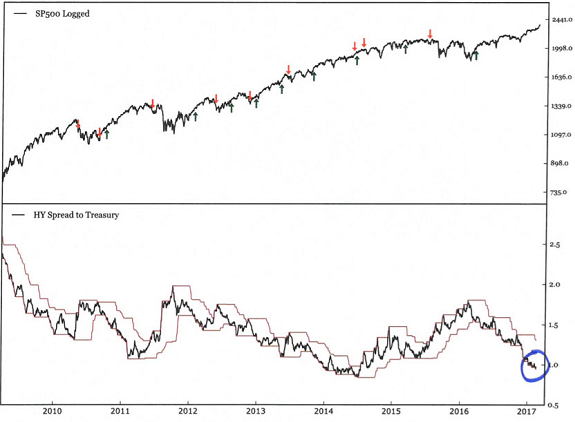

But easing a market’s big worry are credit spreads which continue to tighten toward decade lows…

(RenaissanceMacro)

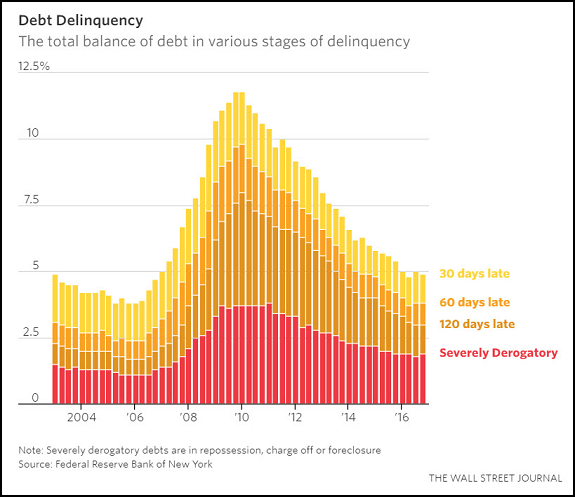

Tighter spreads make sense with little sign of consumer financial distress…

(WSJ)

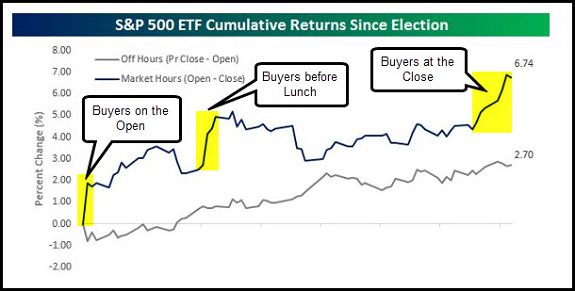

A great chart from Bespoke this week showing the ongoing buying demand in the equity markets…

The chart below breaks down the returns of SPY between market hours (9:30 AM to 4:00 PM) and overnight returns (4:00 PM through the 9:30 opening bell). Often, when you see a big market rally, a lot of the gains come from ‘gaps’ where overnight news or events cause the market to open significantly higher, and unless you were long overnight, you miss out on the move. What is notable about the rally since the election is that the majority of the gains have come during market hours. The cumulative gain of SPY during market hours since Election Day has been a gain of 6.74%. In other words, if you bought at the open and sold at the close every day, you would be up 6.74% and eliminated any possible risk of holding equities overnight. Conversely, if you bought at the close and sold at the open every day since the election, your cumulative gain would be just 2.7%, or less than half of the gain from being long during the trading day!

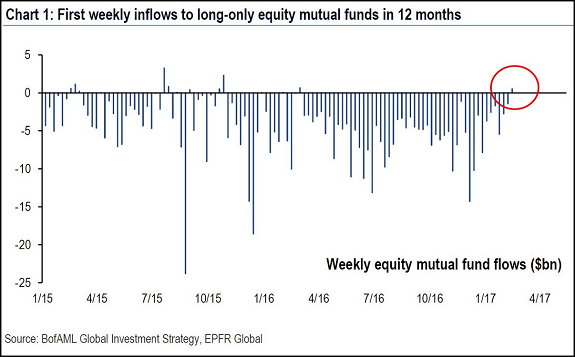

Maybe the continued buying is a result of mutual fund flows turning positive…

(@TN)

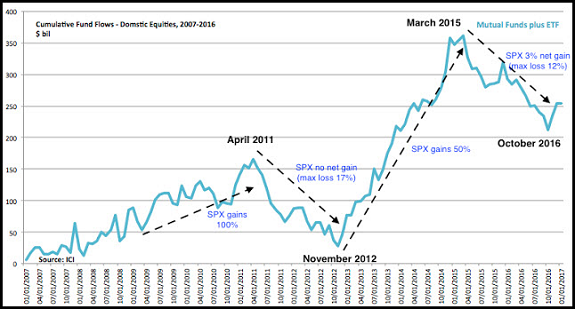

It is important to note that mutual fund inflows do matter…

Much easier to make a giant snowman when it is snowing and there is plenty of snow on the ground.

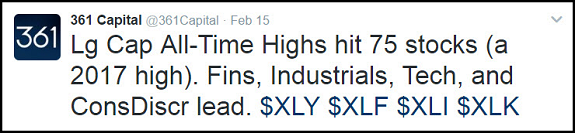

Wednesday saw the largest number of all-time highs in 2017…

Here are the individual names which I hope you own handfuls of…

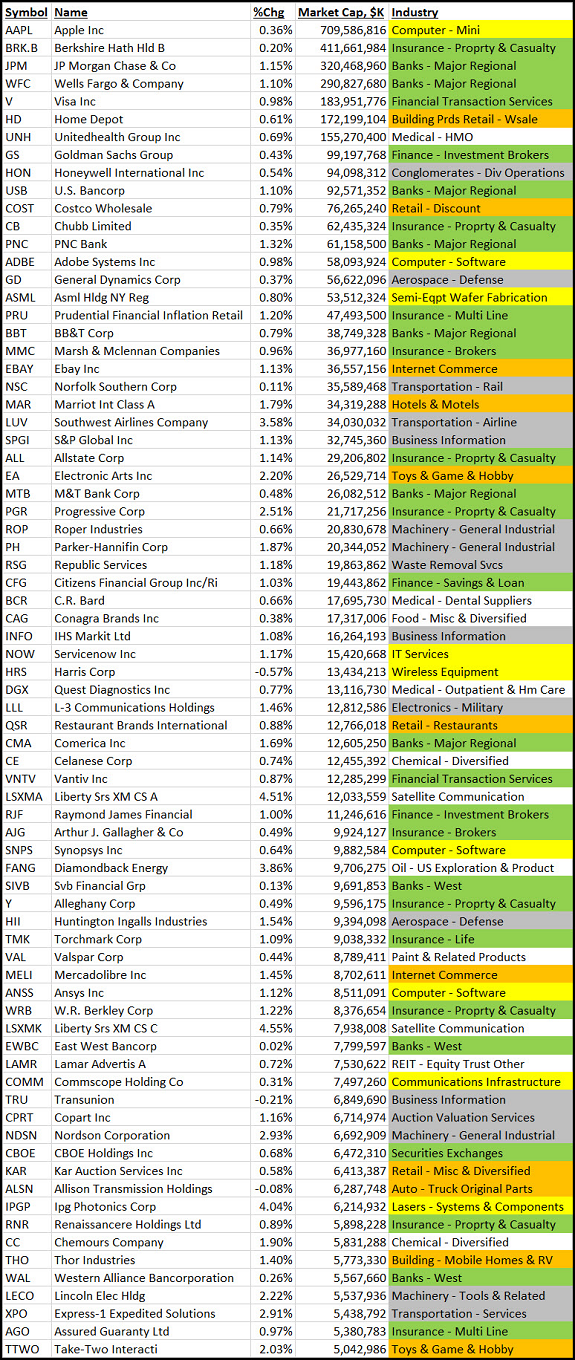

The top group last week is now worth keeping a much closer eye on…

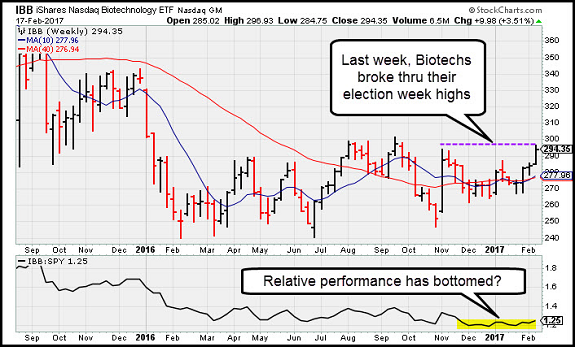

Meanwhile, the Financials put the hammer down on the spike in interest rates plus a dovish Fed resignation…

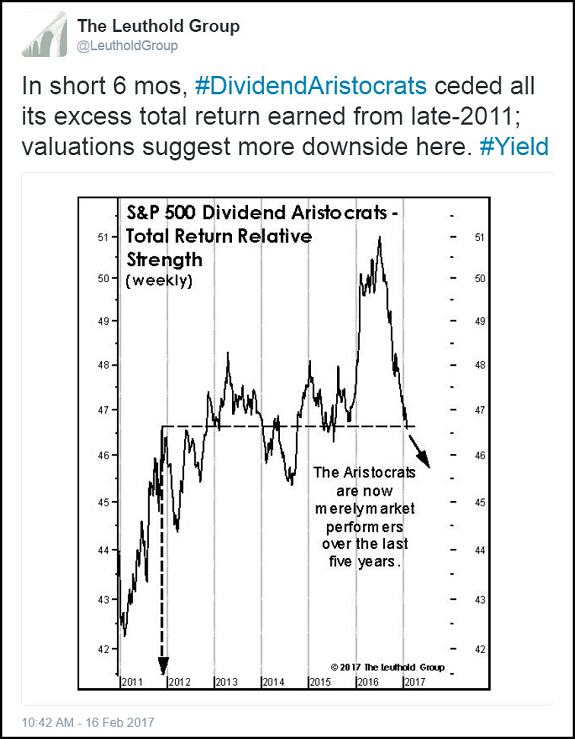

Speaking of rising interest rates, the high dividend group has now given up six years of stock price outperformance…

Jones Institutional always does a good job of quickly filtering through the quarterly 13F filings…

Some of the 13F Filings that got my attention:

- Trian Fund Management, one of the biggest activist investors, has built up a more than $3 billion stake in PG

- Buffett’s stake in AAPL gets the headers – but look at what he is amassing in the airlines (AAL, DAL and UAL) despite criticizing airlines for decades as money-losers.

- Big dive into the Financials – Soros (GS – but sold BAC), Cooperman (FGL), Druckenmiller (C, JPM, WFC), Bacon (C, SYF, VOYA), Loeb (BAC, GS, JPM)

- Retail Hated – Buffett (WMT), Einhorn (KORS, DDS), Klarman (ODP), Dalio (KSS, VFC, WHR), Druckenmiller (AMZN)

- Nibbling in HC – Tepper (PFE, MYL, AGN, TEVA), Jana (NUVA, ACAD), Baupost (ABC, CAH, MCK)

- Gold – Burbank’s Passport adds 5mln shares, eclipsing Paulson as the largest HF holder

- Hedge funds trim bets on FANG Stocks – Cooperman, Loeb, Laffont, Soros among them

- Hedge funds bought more shares of Bank of America Corp. than any other company in the fourth quarter

David Tepper’s Appaloosa went big on pharma stocks in the fourth quarter…

The fund took big new positions in Teva ($183 million), Pfizer ($156 million), and Mylan ($125 million) in the final three months of the year, according to a 13F filing. They were the fund’s biggest new positions in the period.

In addition, Appaloosa raised its stake in Allergan by 250%, increasing its position by around 3 million shares to a stake worth $894.9 million. The additional shares are worth around $660 million, and Allergan is now the firm’s top holding.

The combined investment in the three new pharma positions and the increased Allergan stake adds up to around $1 billion.

Duquesne Family Office (Stanley Druckenmiller) discloses updated portfolio positions in 13F filing

Highlights from 2016 Q4 filing as compared to 2016 Q3 filing:

New positions in: HAL (~1.04 mln shares), WFC (~0.96 mln), C (~0.93 mln), SWN (~0.83 mln), RIG (~0.7 mln)

Increased positions in: BAC (to ~2.56 mln shares from ~1.58 mln shares), PNC (to ~0.47 mln from ~0.07 mln), NUE (to ~0.36 mln from ~0.2 mln), EOG (to ~0.38 mln from ~0.27 mln), PXD (to ~0.11 mln from ~0.05 mln) WMB (to ~0.33 mln from ~0.28 mln)

Maintained positions in: ABBV (~1.22 mln shares), MRK (~0.68 mln)

Closed positions in: ABT (from ~1.07 mln shares), EPI (from ~0.95 mln), MU (from ~0.93 mln), AMAT (from ~0.78 mln), ATVI (from ~0.75 mln), NKTR (from ~0.57 mln), INTC (from ~0.55 mln), AEM (from ~0.53 mln), JUNO (from ~0.49 mln), ZTS (from ~0.48 mln)

Decreased positions in: FCX (to ~2.88 mln shares from ~4.88 mln shares), PSTG (to ~0.93 mln from ~1.98 mln)

(Briefing)

America’s addiction to their smart phones is causing rising auto insurance prices today. Tomorrow it will cause a surge in self-driving cars…

The connection between phones and collisions surfaced in insurers’ earnings. Fourth-quarter underwriting results for personal auto insurance worsened at Travelers Cos., Hartford Financial Services Group Inc., and Horace Mann Educators Corp., and all three said distracted driving was partly to blame. The three companies insure millions of vehicles across the U.S.

“Distracted driving was always there, but it just intensified as more applications for the smartphones became available,” said Bill Caldwell, executive vice president of property and casualty at Horace Mann, in a recent interview. The insurer expects to raise rates 8% this year, on top of average 6.5% increases in 2016.

The average U.S. car-insurance premium rose to an estimated $926 in 2016, according to trade group Insurance Information Institute, up 16% from 2011. Rates are rising despite predictions that they would fall as more vehicles moved out of showrooms with high-tech anticollision gear.

The number of deadly accidents jumped 7.2% in 2015, according to the National Highway Traffic Safety Administration. A recent report from the nonprofit National Safety Council showed an estimated 6% rise for 2016.

(WSJ)

Bill & Melinda Gates found a 44-bagger for Warren Buffett to invest in…

Bill: Remember the laugh we had when we traveled together to Hong Kong and decided to get lunch at McDonald’s? You offered to pay, dug into your pocket, and pulled out…coupons! Melinda just found this photo of me and “the big spender.” It reminded us how much you value a good deal. That’s why we want to point you to this number, 122 million. Saving children’s lives is the best deal in philanthropy.

Melinda: And if you want to know the best deal within the deal—it’s vaccines. Coverage for the basic package of childhood vaccines is now the highest it’s ever been, at 86 percent. And the gap between the richest and the poorest countries is the lowest it’s ever been. Vaccines are the biggest reason for the drop in childhood deaths.

Melinda: They’re an incredible investment. The pentavalent vaccine, which protects against five deadly infections in a single shot, now costs under a dollar.

Bill: And for every dollar spent on childhood immunizations, you get $44 in economic benefits. That includes saving the money that families lose when a child is sick and a parent can’t work.

Melinda: At the start, we just couldn’t understand why vaccines weren’t available to every child who needed them. We were naïve. There were no market incentives to serve people, and we had never seen that before.

Bill: The market wasn’t working for vaccines for poor kids because the families who needed them couldn’t afford them. But this gave us an opening. If we could create a purchasing fund so pharmaceutical companies would have enough customers, they’d have the market incentives to develop and produce vaccines.

Online degrees at major universities continue to grow…

The University of Colorado is charging ahead on a plan to create a three-year, fully online degree and hopes to launch the new program in the fall of 2018, according to William Kuskin, vice provost and associate vice chancellor for strategic initiatives.

Once the program is fully implemented, a student will be able to get a bachelor of arts degree in interdisciplinary studies by taking online classes offered by all four CU campuses.

If they stick to a rigorous course schedule, they can complete their degree in three years, without ever stepping foot inside a classroom, Kuskin said.

This intercampus online degree program will take advantage of the more than 800 classes CU’s four campuses already offer online. Students will be able to piece together their own major by blending courses from across different departments.

Speaking of education, some great news for female computer science engineers: Uber will soon be hiring only women…

When I joined Uber, the organization I was part of was over 25% women. By the time I was trying to transfer to another eng organization, this number had dropped down to less than 6%. Women were transferring out of the organization, and those who couldn’t transfer were quitting or preparing to quit. There were two major reasons for this: there was the organizational chaos, and there was also the sexism within the organization. When I asked our director at an org all-hands about what was being done about the dwindling numbers of women in the org compared to the rest of the company, his reply was, in a nutshell, that the women of Uber just needed to step up and be better engineers.

Copyright © 361 Capital