by Don Vialoux, Timingthemarket.ca

Observations

North American equity markets survived a scare yesterday. The VIX Index spiked at the opening in response to a breakdown on the charts by the U.S. Dollar Index triggered by uncertainties related to Trump’s political agenda following withdrawal of the Health Care bill. The Index settled down in late trading.

Conversely, the Euro moved above 108.29 completing a reverse Head & Shoulders pattern.

StockTwits Released Yesterday @EquityClock

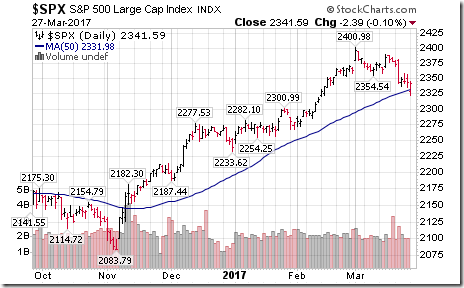

The NASDAQ Composite Index and S&P 500 Index have opened below their 50 day moving averages. $SPY $QQQ

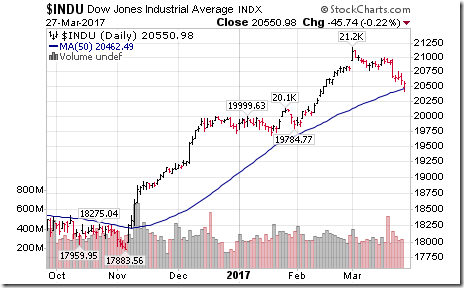

Editor’s Note: The Dow Jones Industrial Average also briefly moved below its 50 day moving average.

U.S. Dollar Index dropped below support at 99.19 completing a Head & Shoulders pattern. $UUP

Technical action by S&P 500 stocks to 10:00: Bearish. 27 stocks broke intermediate support. One stock broke resistance: $HCA.

Editor’s Note: After 10:00 AM EDT, breakout included HCN and breakdowns included IPG, HRL, MUR, MET, RHI, CTL, CAG and TAP.

Notably weaker were Financials. Breakdowns: $AJG $AIG $BAC $HIG $L $MS $MTB $PGR $PRU $SCHW $STI $XL

Agriculture ETF $MOO moved below $53.07 completing a Head & Shoulders pattern.

Materials SPDRs $XLB moved below $51.17 completing a Head & Shoulders pattern.

Base Metal stocks and ETFs breaking support: $ZMT.CA $XME $FCX $LUN.CA $HBM.CA

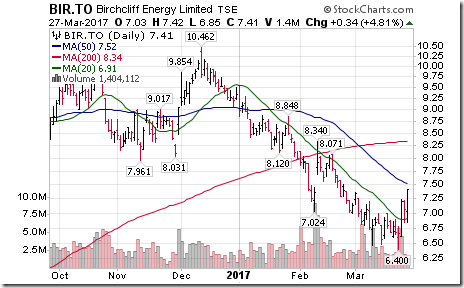

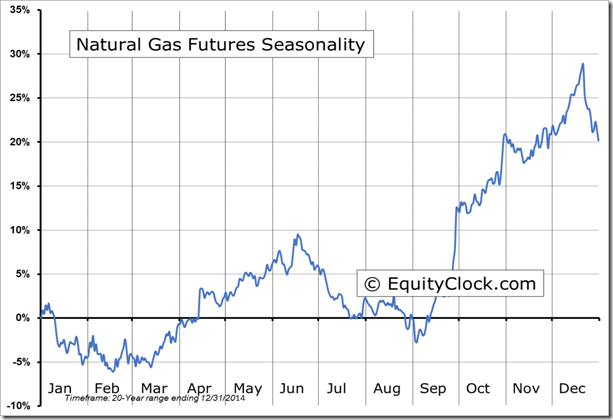

Finally, Cdn. “Gassy” stocks respond to higher natural gas prices: $AAV.CA $BIR.CA

‘Tis the season for strength for Natgas prices and “Gassy” stocks to move higher!

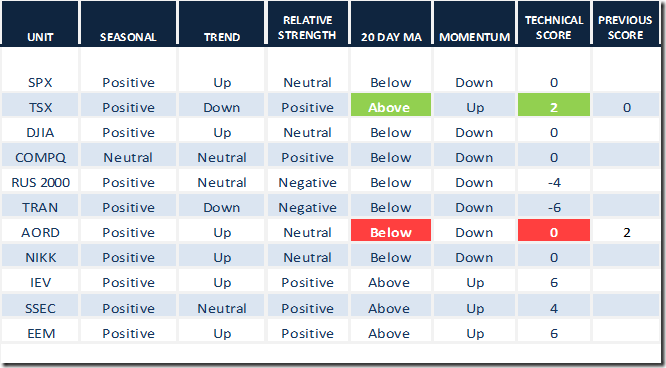

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 27th 2017

Green: Increase from previous day

Red: Decrease from previous day

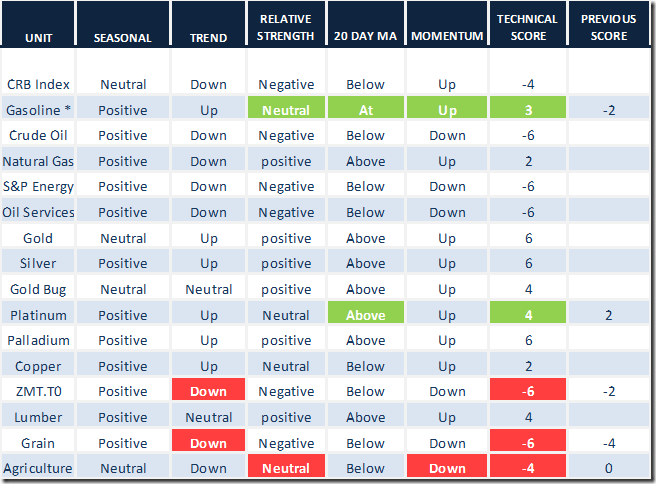

Commodities and related ETFs

Daily Seasonal/Technical Commodities Trends for March 27th 2017

Green: Increase from previous day

Red: Decrease from previous day

* Excludes adjustment from rollover of futures contracts

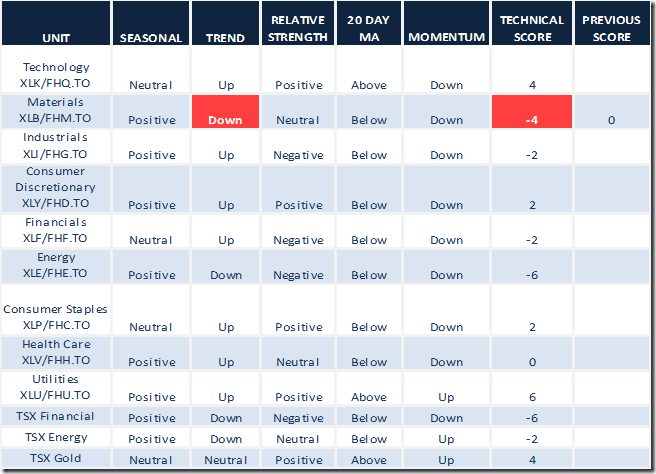

Sectors

Daily Seasonal/Technical Sector Trends for March 27th 2017

Green: Increase from previous day

Red: Decrease from previous day

CSTA Event

Next Toronto chapter meeting

Date: April 12th

Location: Toronto CFA Society Classroom, Suite 701, 120 Adelaide St. W

Presenter: Colin Cieszynski

Topic: An integrated approach to fundamental and technical analysis techniques

Register: www.csta.org

Cost: Free for first time participants. Space is limited.

S&P 500 Momentum Barometer

The Barometer dropped another2.60 to 53.20 yesterday. It remains intermediate overbought and trending down.

TSX Momentum Barometer

The Barometer gained 3.93 to 47.92 yesterday. It remains neutral.

Disclaimer: Seasonality and technical ratings offered in this report and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca