by Adam Butler, Resolve Asset Management

This is the first of a three-part series we’re affectionately calling “How to Get Comfortable with Being Uncomfortable.” The series covers the tremendous headwinds traditional investors will likely face in the next 10 years and the steps required to turn a bad situation into a great opportunity to thrive not just in the next cycle but for the rest of their investment lives. These steps – set realistic expectations, diversify as much as you can handle, and take advantage of others’ mistakes with factor investing – are designed to help investors through whatever the future holds.

We Can’t Discuss Solutions Until We Admit Valuations are a Problem

When most investors think about “risk reduction” their minds immediately conjure volatility and losses. However, as advisors we should consider a broader definition of risk that connects more directly to how clients feel about their investments. Specifically, advisors should define risk as the probability that clients won’t meet their financial goals. Advisors should have the singular objective of minimizing this risk.

This new definition of risk profoundly shifts the conversation away from volatility and losses, and toward strategies that achieve minimum required returns, in a relatively stable sequence. From this new perspective, it is not sufficient to manage risk and provide downside protection; an investment strategy must also produce returns that fulfill long-term goals. Moreover, the strategy must account for the fact that investors are susceptible to shorter-term dynamics, such as tracking error relative to domestic benchmarks, which may run counter to the objective of long-term wealth maximization. In other words, advisors need to build portfolios that are financially optimal, but that investors can stick with over time.

Advisors must look to alternative sources of return to fill the gap, but this presents a different complication. These alternative sources of return will behave very differently than what clients are used to. They also come with large tracking errors to typical benchmarks. As a result, clients run a high risk of abandoning these strategies before they have a chance to perform.

This is not a trivial undertaking. In this three part series, we will discuss the tradeoffs that investors currently face in balancing a preference for simple and familiar solutions against the reality of low prospective returns on traditional portfolios. To boil it down, investors who insist on conventional investment solutions must be prepared to make sacrifices in other areas, because these portfolios may fall well short of delivering the returns they need. Investors who choose the conventional route must be prepared to buckle down, save considerably more of their annual income, and lower lifestyle expectations. This is a perfectly legitimate choice, and we believe most investors will no doubt choose this route, mostly by default.

However, as we will elucidate in parts 2 and 3 of this series, there may still be opportunities to meet financial objectives with robust portfolio growth, for those investors who are able to think differently about the problem. In other words, investors who embrace unconventional, but well-founded investment strategies may be able to preserve their lifestyle objectives. But investors must be prepared for the fact that these alternative strategies will behave very differently than what they are used to. Worse, their portfolios will rise and fall out of sync with the portfolios of their friends and peers. As a result, clients run a high risk of abandoning these strategies before they have a chance to perform.

The current environment presents unique challenges that make it extremely difficult to engineer a traditional portfolio with expected long-term returns that are consistent with client objectives. This first article provides an analytical framework for setting expectations about future returns on traditional asset classes.

Bond Yields and the Equity Risk Premium Imply Low Future Returns

Expected bond returns are least controversial, so let’s start there. The weighted average yield-to-maturity for the widely held iShares U.S. Aggregate Bond Index ETF is 2.55% net of expenses, with a weighted average maturity of eight years. The Barclays Global Aggregate yields just 1.66%. This is a good proxy for the actual return that investors in this fund might expect over the next decade or so[1].

What about stocks? Let’s start with an unbiased assumption that the equity sleeve of a typical investment portfolio will earn the historical long-term excess return of a globally diversified equity portfolio. Global equities have produced compound returns about 4.2% above T-bills over the long-term, and 3.2% above 10-year Treasury bonds. T-Bills currently yield about 0.5% and benchmark Treasury bonds yield 2.35%, suggesting that a diversified global stock portfolio should earn nominal returns between 4.7% – 5.5% over the next decade or so. Let’s assume 5.5% to err on the side of optimism.

Let’s examine what these expected returns from stocks and bonds might mean for traditional portfolios over the next ten or fifteen years. To achieve a 5% nominal return, an investor would need to own a pure equity portfolio, with all of its accompanying risks. A traditional 60/40 portfolio might be expected produce about 60% * 5.5% return + 40% * 2% return = 3.3% + 0.8% = 4.1% nominal.

However, the expectations above assume that there are no other factors that might bias expectations in one direction or another. While the mathematics of bond returns provide relatively accurate forecasts based on starting yields, forecasting equity returns is a more daunting exercise. There are some tools that can help to move the expectation needle, but unfortunately they do not paint a very optimistic picture at present.

High Valuations Also Imply Low Future Returns

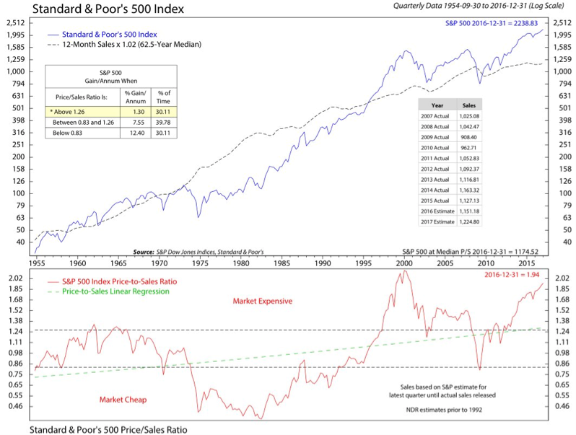

Stocks are expected to produce an average excess return only when they are priced near average valuations. But many stock markets are currently quite expensive. U.S. stocks, which represent over half of total global stock market capitalization, are trading near record valuations according to some measures. For example, the S&P 500 U.S. stock market index is trading near its 2000 bubble peak as a multiple of total revenues (Figure 1). Should stocks retrace to average valuations by this measure in an acute correction, investors would endure a 48% decline. If they were to mean-revert over a longer horizon, they would face a material headwind on long-term returns.

Figure 1. S&P 500 Index and Price-to-Sales Ratio, 1955-2016

Source: Ned Davis Research

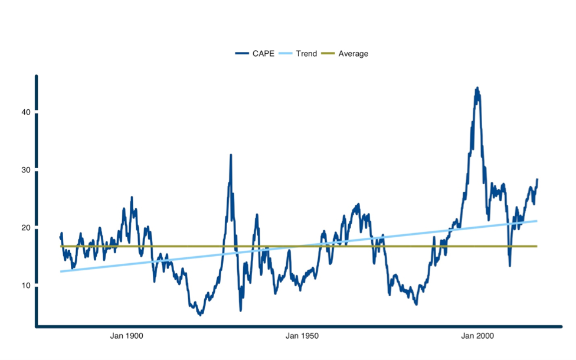

Another popular measure of stock market valuation is the cyclically adjusted price-to-earnings (CAPE) ratio, proposed by Dr. Robert Shiller. This measure accounts for the volatility of earnings through a full business cycle by taking the average of aggregate earnings over the past decade, adjusted for inflation.

By this metric, U.S. stocks are also expensive relative to history, sitting at a ratio of 28.5, about 70% above their long-term average value of 16.7. Some argue that the equilibrium CAPE should rise through time for structural reasons, such as declining economic volatility, and improved stock market transparency and liquidity. This would make the long-term average less relevant. To account for this, we found the line of best fit describing the steady growth in CAPE over time. Even accounting for trend growth in multiples, stock valuations are still 35% above their neutral value (Figure 2).

Figure 2. S&P 500 Cyclically Adjusted Earnings Ratio, 1881 – 2016

Source: ReSolve Asset Management. Data from Robert Shiller

While it has paid to be optimistic about stocks over the past century, it is also prudent to be realistic about the probabilities. It is highly likely that investors will earn about 2% on high-grade fixed income, and probably much less than 6% per year on stocks over the next decade or more. In the optimistic case that equities revert to average trend valuations over the next fifteen years, this would represent a 35%/15 = 2.3% per year drag on equity returns. As a result, equity return expectations would drop from 5.5% per year to 3.2%. You can see how, after adjusting for inflation and fees, investors will be hard pressed to earn more than 2% per year on traditional portfolios.

Hopefully we can agree that 2% returns – returns implied by current valuations – are a problem. In the next article, we will propose one incremental solution to this problem, by embracing a strategy of extreme diversification. In part 3, we will explore alternative sources of return that behave very differently than traditional assets, but which may offer attractive performance prospects to help investors meet their financial goals.

[1] Current yields forecast future bond total returns most accurately at a forecast horizon equal to twice the portfolio duration. See Leibowitz, Martin, and Anthony Bova (December 18, 2012), “Duration Targeting: A New Look at Bond Portfolios (Morgan Stanley Research).” At www.q-group.org/inc/uploads/2014/01/2013sp-Leibowitz-Bova-Duration-Targeting-121812.pdf.

Copyright © Resolve Asset Management