by Don Vialoux, Timingthemarket.ca

Observations

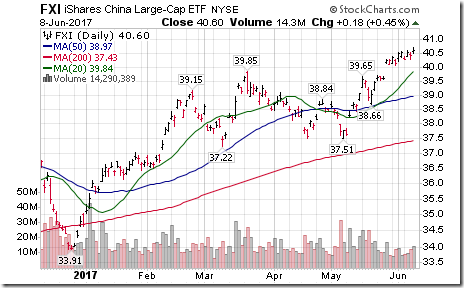

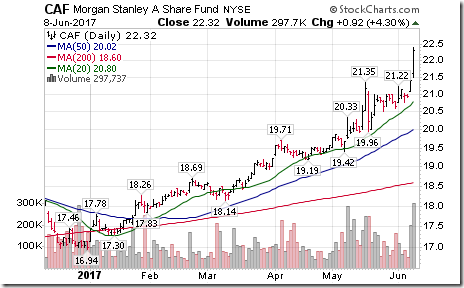

China awakens

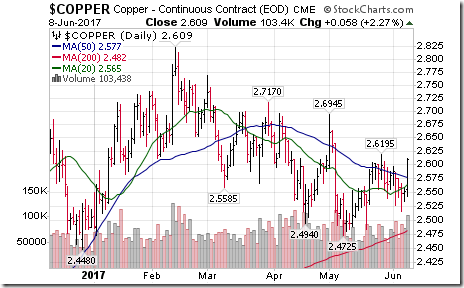

Copper prices responded.

Ditto for copper stocks!

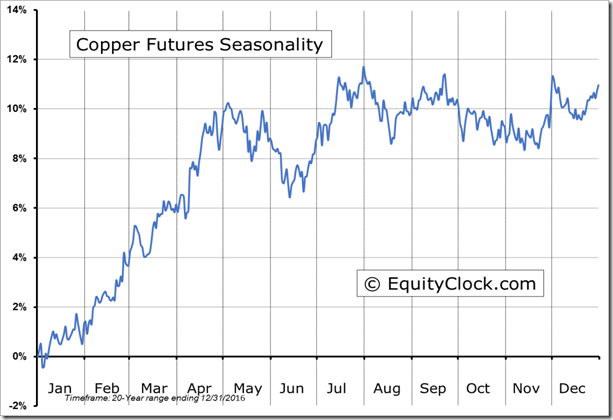

Copper prices normally move higher until the end of July.

StockTwits Released Yesterday @EquityClock

Oil falling back to the lower limit of a declining trend channel. See

http://www.equityclock.com/2017/06/07/stock-market-outlook-for-june-8-2017/

Technical action by S&P 500 stocks: Quietly bullish. Breakouts: $YHOO $C $STT. No breakdowns.

Editor’s Note: After 10:00 AM EDT, breakouts included TIF, ZBH, ETFC, MS, TROW and ZION. Breakdown: TJX. Bank stock responded to news that the House of Representatives introduced a bill to curtail regulatory requirements previously imposed by Dodd-Frank. Regional bank stocks and its related ETF were notably stronger.

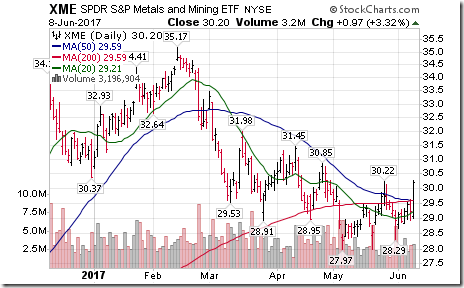

U.S. Metals & Mining ETF $XME moved above $30.22 developing a short term uptrend

BMO Base Metals ETF $ZMT.CA moved above $9.69 establishing a short term uptrend.

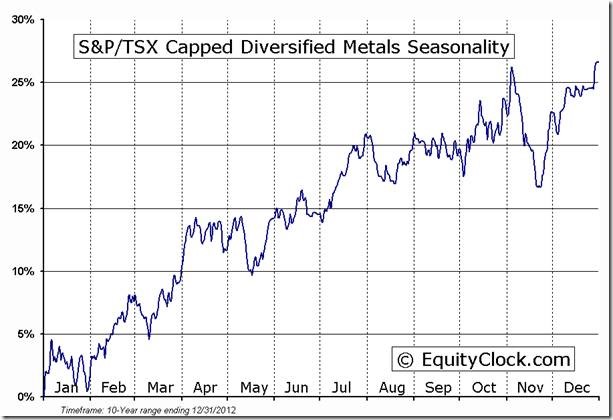

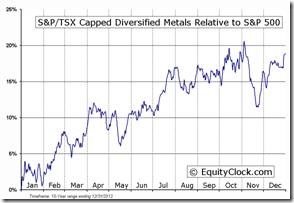

Editor’s Note: Seasonal influences are positive on real and relative basis for the base metal sector until the end of July.

S&P/TSX Capped Diversified Metals Seasonal Chart

Trader’s Corner

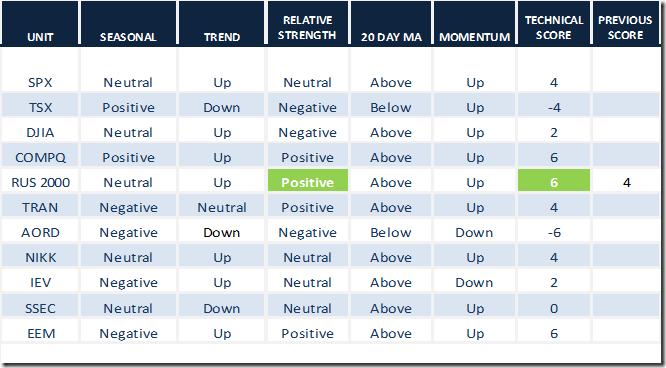

Daily Seasonal/Technical Equity Trends for June 8th 2017

Green: Increase from previous day

Red: Decrease from previous day

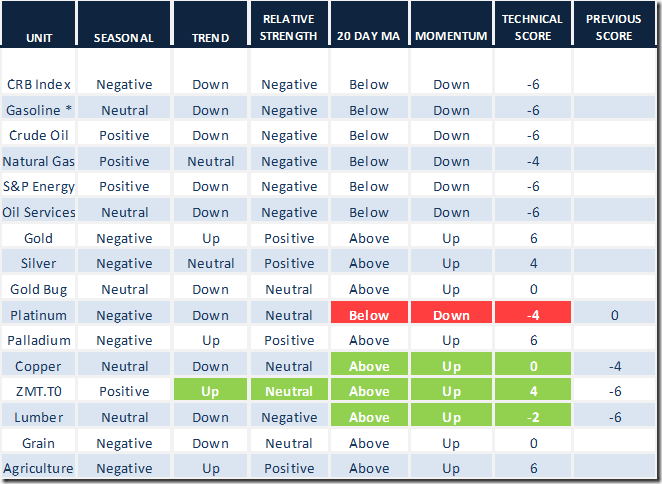

Daily Seasonal/Technical Commodities Trends for June 8th 2017

Green: Increase from previous day

Red: Decrease from previous day

* Excludes adjustment from rollover of futures contracts

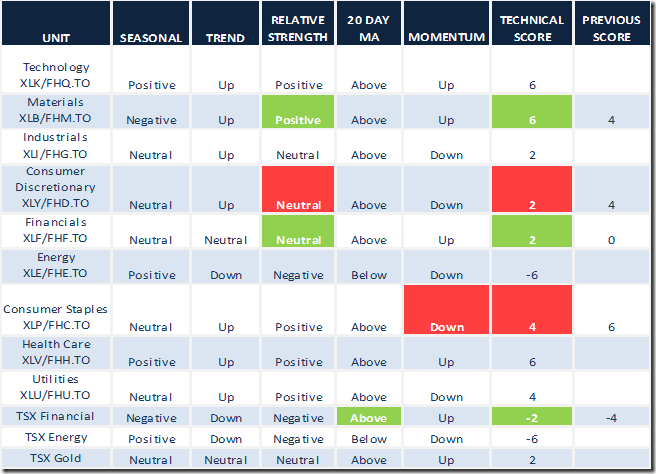

Daily Seasonal/Technical Sector Trends for June 8th 2017

Green: Increase from previous day

Red: Decrease from previous day

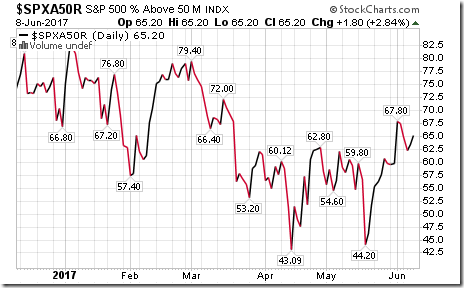

S&P 500 Momentum Barometer

The Barometer gained 1.80 to 65.20 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer added 2.69 to 44.08 yesterday. It remains intermediate neutral and in a downward trend.

Disclaimer: Seasonality and technical ratings offered in this report and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca