by Donald Huber, Franklin Templeton Investments

It’s easy for investors to fall into what is known as “home country bias,” looking only within their own country’s borders for opportunities. That isn’t the case with Franklin Equity Group Portfolio Manager Don Huber—who is always searching the globe for quality growth opportunities. He says investors may be missing the boat if they don’t expand their opportunity set beyond their shores.

Why International Equities? Four Reasons

I think there are a few things beginning to align that could lead international equities to outperform US equities.

One is that that we just passed the one-year anniversary of President Trump’s US stimulus package, which included tax cuts and some deregulation. The impact of that stimulus is now wearing off.

Second, trade negotiations between the United States and China remain uncertain, which could conceivably affect US-Europe trade relations, too. While US equities enjoyed a strong first-quarter performance, trade-related setbacks have certainly had a negative impact on sentiment for US equities at various points over the last year or so—and could again.

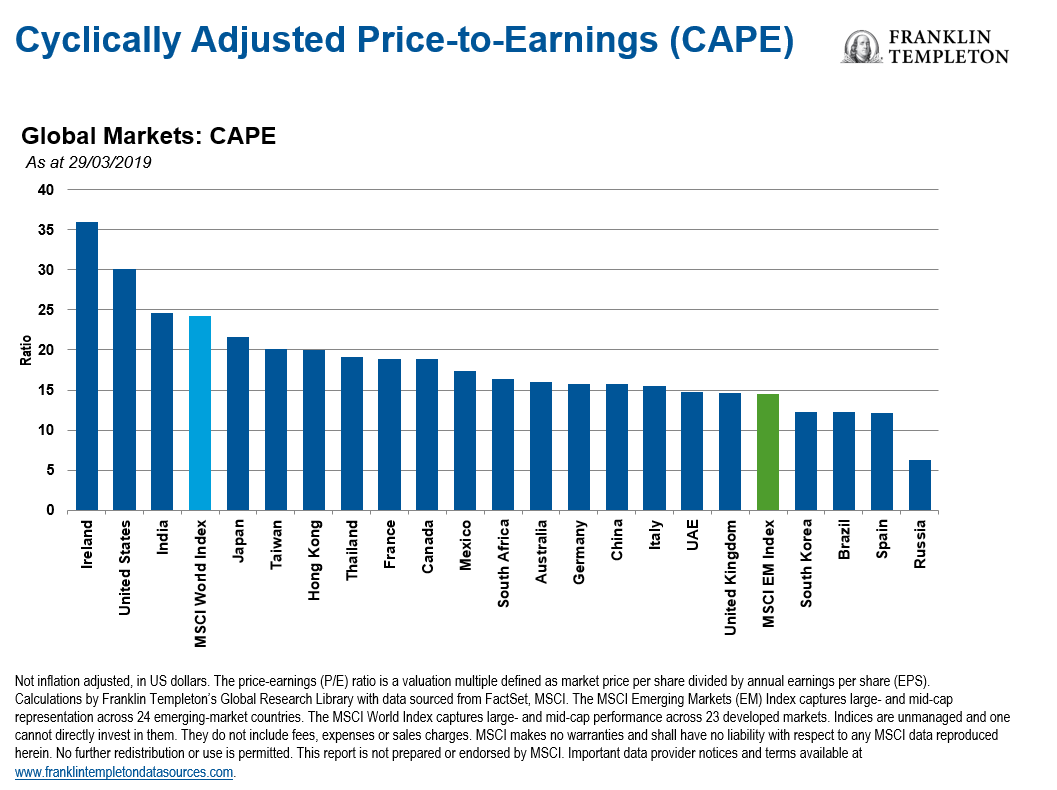

And third, international equities are generally less expensive than US equities. I think that valuation disparity is likely to be in many investors’ minds (or perhaps should be) as they’re making asset allocation decisions going forward.

Lastly, the strength of the US dollar has been a headwind for US investors investing offshore over the last few years. Rising interest rates typically support a strong dollar, and we saw the US Federal Reserve (Fed) tighten rates nine times from 2015-2018.

However, this year the Fed has indicated it will pause, so we may see that headwind either abate or become a tailwind for US investors’ returns from markets outside the United States.

Growth, Quality and Valuation

Our team looks for companies that demonstrate growth and quality, and are trading at what we view as a reasonable valuation. Those three elements tend to lead us to companies with sustainable business models that we think we can own for several years. That includes emerging-market companies.

Emerging markets represent a substantial portion of global stock market capitalisation, so we think not including emerging markets means missing a large opportunity set.

Moreover, while US corporate earnings appear likely to grow faster than corporate earnings in developed international markets over the medium term, we believe that through fundamental research investors can uncover companies growing much faster than the average.

New Technological Innovations Create Opportunities

The automobile industry is one area where we are finding interesting growth opportunities. Think of the trend of increased electrification of cars as we begin to transition away from internal combustion engines, to hybrid and eventually fully electric cars. Think about the electrical complexity of an automobile, the need for sophisticated battery materials to power that and the need for semiconductors to control the increased number of electronic components and sensors.

Another aspect of the automotive industry we’re excited about is fully autonomous driving. But you don’t need to wait for fully autonomous vehicles to become ubiquitous to recognise the number of steps that are needed to reach that end goal.

The number and types of active safety features on cars are increasing. Standard equipment on automobiles—things like lane-change warning signals, adaptive cruise control, emergency braking when you’re backing up—are features that are here today. And, the companies that supply those components are benefitting.

Another area where we continue to see potential opportunity is e-commerce. Clearly, the penetration of e-commerce relative to brick-and-mortar retailing continues to increase across the globe.

There are parts of the world where that penetration is at much lower levels and e-commerce is a much younger phenomenon. And, in some emerging markets where no existing brick-and-mortar infrastructure was ever in place—think banking for example—it can be relatively inexpensive and quick for businesses and consumers in these countries to adopt and use these new technologies exclusively.

Here’s a video on home country bias to help bring the point home about investing globally.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity.

Copyright © Franklin Templeton Investments