by David Zahn, CFA, FRM, Franklin Templeton Investments

Investors are having to come to terms with the return of volatility. After several years of relatively stable conditions, the slide in equities at the end of last year and the subsequent recovery in the first quarter of 2019 were a stark reminder not to become complacent. David Zahn, Head of European Fixed Income, Franklin Templeton Fixed Income Group, looks at the implications for the gilts market and explains why he believes an active approach to gilts management makes sense now.

We believe investors should continue to expect a degree of volatility as markets unpack the uncertainty surrounding Brexit, global trade spats and pessimistic economic outlooks in certain regions of the world.

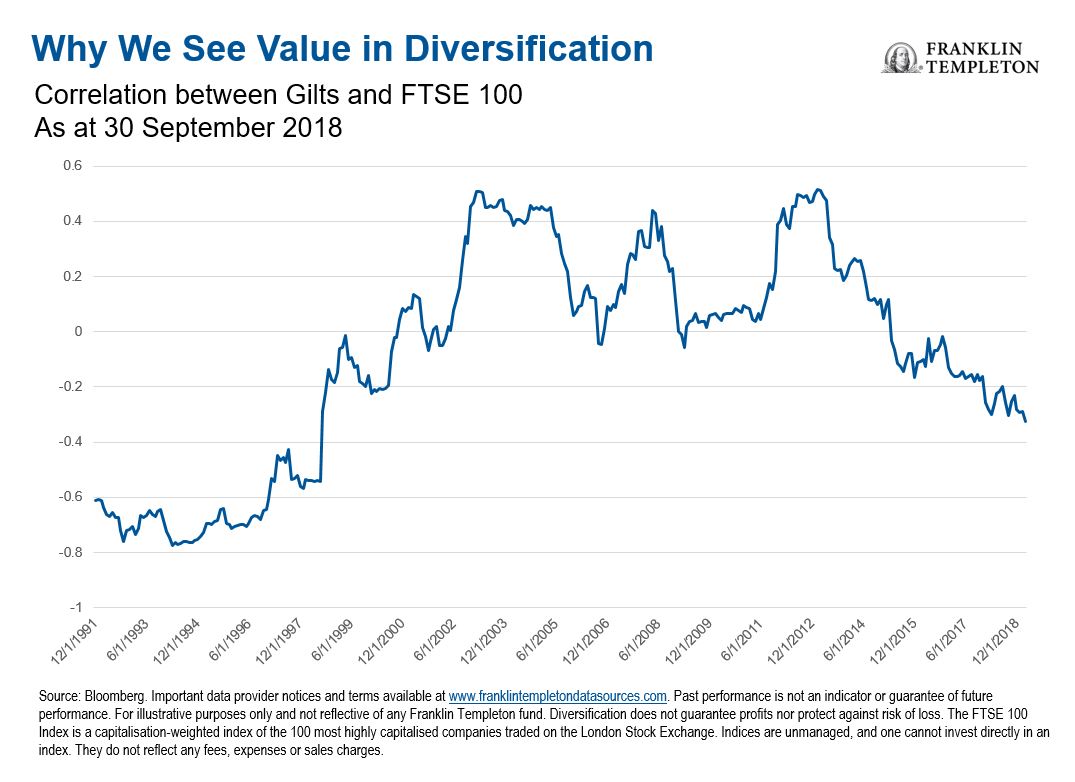

If we look back over the last 10 to 15 years, there have been times when bonds and equities were positively correlated.1

Now we’re starting to see that negative correlation coming back.

Against that background, we’d expect growing interest in gilts (UK government bonds), which have traditionally provided steady returns in times of heightened volatility.2

Low Point of Gilt Yields

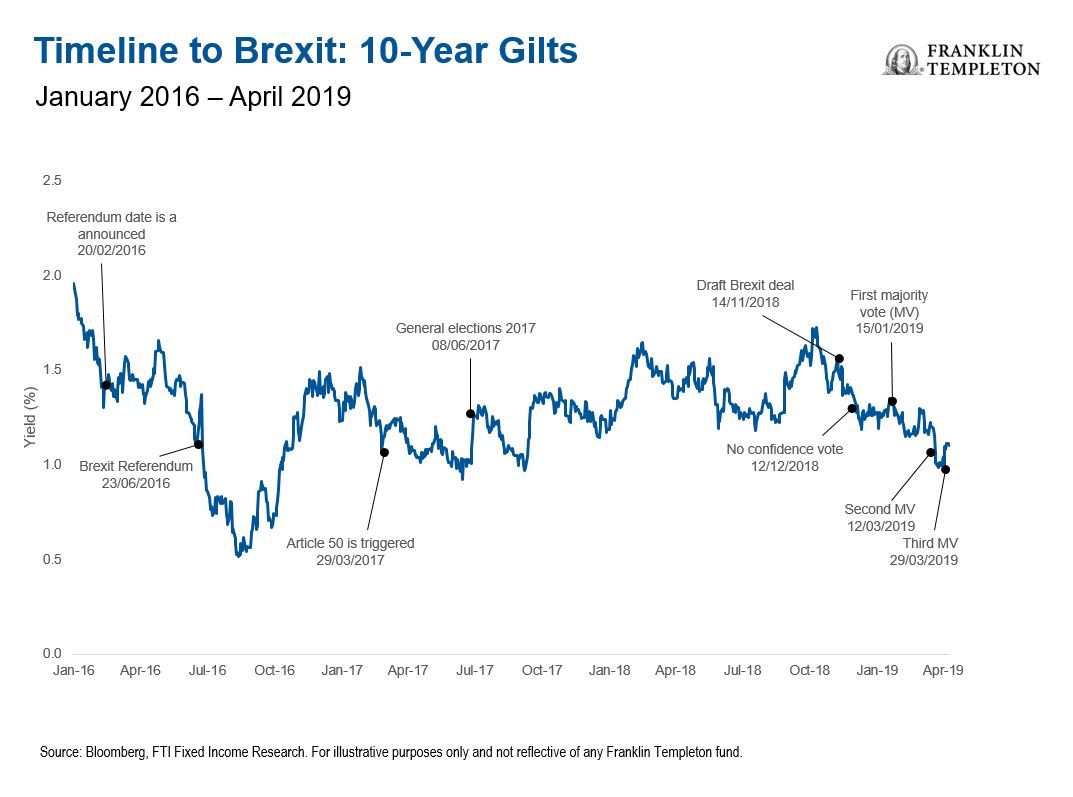

In our view, we’re at the low point of gilt yields in the cycle, in part due to the uncertainty surrounding the Brexit outcome.

We don’t feel there’s much likelihood of yields falling further.

Equally, we don’t expect any imminent increase in interest rates across major developed economies, which could send yields on an upward trajectory.

We don’t expect the European Central Bank (ECB) to begin raising interest rates until at least 2021. Similarly, we think the Bank of England’s Monetary Policy Committee (MPC) is unlikely to raise rates for at least a couple of years until it sees a Brexit resolution. The US Federal Reserve (Fed) has said it’s not going to raise interest rates this year and the Bank of Japan is still implementing quantitative easing (QE).

But the bond market—particularly the longer-dated securities—doesn’t always move just based on central bank activity.

For example, we think gilts yields currently are artificially low, because of the Brexit uncertainty.

Once Brexit is settled, we think fundamentals could reassert themselves. Therefore, we should see yields start to rise once a resolution emerges.

At the same time, if there were to be a growth surprise to the upside, you could see yield curves— the graphical representation of the spread between short- and long-term interest-rate instruments— steepen even before central banks act.

How Do Gilts Fit Into a Portfolio?

We think it’s important for investors not to think of gilts simply as a separate asset class, but to think how it fits into an entire portfolio. And what does it do for risk-adjusted returns.

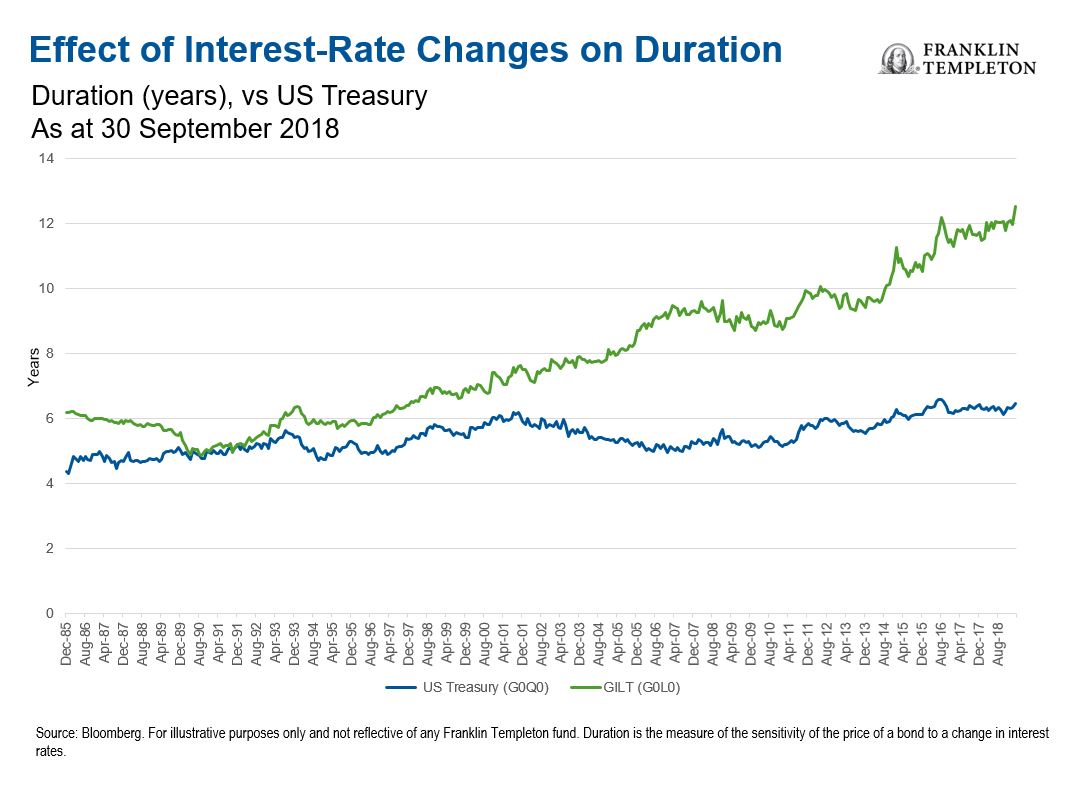

We feel that a gilts allocation can contribute to a balanced portfolio composition. Many people have held gilts in their index-based investment products. But in many cases, they haven’t considered that the duration3 of the gilts market has lengthened dramatically.

Longer duration means more sensitivity to interest-rate changes. So there’s a real chance that by that measure, an index gilt fund is riskier today than it was 10 or 15 years ago.

A passive investment can only follow market turbulence. An active manager strives to use the volatility to an investor’s advantage by actively managing duration.

Gilts have been a very liquid asset so an active manager can move duration in their portfolios (longer or shorter) depending on their analysis of conditions.

Although we don’t expect an interest-rate increase in the United Kingdom in the near future, we do believe it’s important to have the opportunity to move asset allocations and/or the duration of a portfolio without having to make a decision to exit the asset class completely if conditions change.

That generally requires moving away from a passive index approach to an active approach.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments.

__________________________________

1. Duration is a measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates. Duration is expressed as a number of years.

2. Correlation measures the degree to which two investments move in tandem. Correlation will range between 1 (perfect positive correlation where two items have historically moved in the same direction) and -1 (perfect negative correlation, where two items have historically moved in opposite directions).

3. Past performance is not an indicator or guarantee of future performance.

Copyright © Franklin Templeton Investments